Trans-Pacific container shipping capacity is declining again after a sharp increase, as carriers cancel sailings in response to a sudden slowdown in import demand driven by fluctuating tariff policies.

.jpg)

The trans-Pacific container shipping market is experiencing significant volatility, with carriers continuously adjusting capacity in response to unexpected shifts in demand. After a surge in capacity at the end of May, the latest data from Sea-Intelligence shows that this trend is now reversing rapidly, as carriers cancel many previously scheduled sailings.

Initially, on April 9, 2025, the U.S. imposed a 145% tariff on Chinese goods, which caused a sharp decline in demand for trans-Pacific container shipping. In response, carriers reduced capacity on this trade lane. However, the situation changed abruptly when, on May 12, 2025, the U.S. announced a 90-day suspension of tariffs on Chinese goods. This decision immediately triggered a spike in container shipping demand, leading to a capacity shortage and a sharp rise in spot rates. In response, carriers quickly redeployed capacity to this route.

At first, experts predicted that the tariff suspension would pull the traditional August peak season forward to June and July, as U.S. importers rushed to move cargo before the suspension ended. However, throughout June, U.S. importers appeared to hesitate, seemingly reacting to ongoing uncertainty about future regulatory policies. This weakening in container demand, combined with the extra capacity carriers had added, has resulted in a sharp drop in spot rates.

Source: Sea-Intelligence

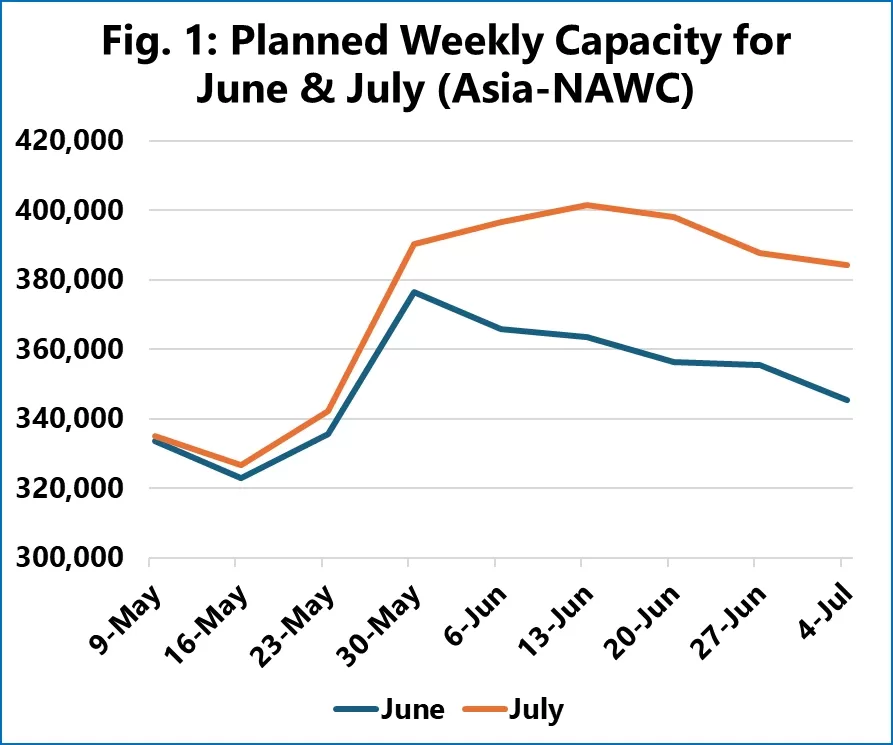

The projected capacity charts for the Asia–North America West Coast (NAWC) trade in June and July, recorded at different points in time, clearly illustrate a shift: capacity increases planned in late May for June have quickly been replaced by capacity reductions during June. Projected capacity for July also peaked in mid-June and has since continued to decline as carriers cancel scheduled sailings.

Compared to the baseline capacity on May 9 (before the tariff suspension announcement), by May 30, carriers had planned to add 770,000 TEU to the market for June and July combined. However, as of July 4, this additional capacity had been reduced to just 590,000 TEU. This means that over the course of June, carriers removed 23% of the planned extra capacity on the Asia–NAWC route in response to importers’ sudden reversal of plans to rush goods from China.

Similarly, on the Asia–North America East Coast route, carriers initially planned to add 348,000 TEU for June and July combined. However, by July 4, this figure had dropped by 24% to just 265,000 TEU in additional capacity.

The flexibility and swift reactions of carriers in adjusting capacity highlight their efforts to rebalance supply and demand and maintain stability in a highly uncertain market, where political and economic factors can reshape the landscape within a very short period.

Source: Sea-Intelligence

------

ASL Logistics US - Your True Shipping Partner

.png)

Reach ASL Logistics US immediately for advice on sea freight service! Or you can contact us directly to receive detailed information:

⚓ ASL Logistics US - Your True Shipping Partner

📍 https://aslc-us.com/

☎ +156 2906 3906

✉ phong@aslc-us.com

Related services: Sea Freight, Air Freight, Customs Broker Service, Domestics Trucking, Multi-modal Transportation, Warehousing Services, Shipping and Logistics Services to The U.S

.png )